FAQ - 15 MTU

OKTE, a.s. Operation Order is placed on the website legislation

- Description of the 15’MTU Project

- Changes in Market result publication

- Changes in Order Submission on the Day-Ahead Market

- Market Evaluation for Participants

- 15 MTU Project Launch

- Market Participant Testing

- Information on Exceptional Situations

Description of the 15’MTU ProjectCollapse all

- What is the 15’ MTU project and why is it being implemented?

-

The 15-Minute Market Time Unit (MTU) project represents a significant reform of the short-term electricity market. The existing trading system based on hourly trading intervals will be changed to 15-minute intervals, enabling more flexible market management and more accurate price formation.

- What are the main reasons for this change?

-

Key objectives of implementing the 15’ MTU project include:

• Reducing the cost of balancing energy

• Better integration of renewable energy sources

• Improved responsiveness to supply and demand fluctuations

• Meeting the requirement of the Electricity Market Regulation to shorten trading intervals to the imbalance settlement period - What benefits will the 15’ MTU project bring to market participants?

-

• Higher accuracy of trading forecasts

• More efficient use of trading strategies

• Increased flexibility in trading, especially for renewable energy

• More accurate calculation of the marginal price for shorter trading periods

Changes in Market result publicationCollapse all

- What information will be available on the website?

-

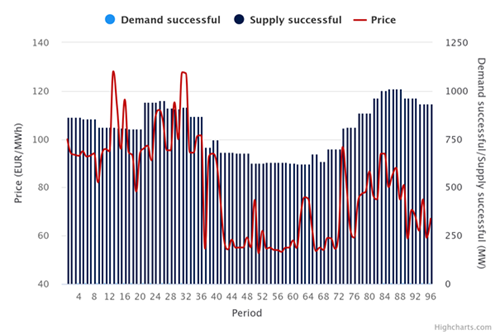

After the 15’ MTU project is implemented, data will be published in 15-minute intervals instead of the current hourly blocks — moving from 24 to 96 periods per day. OKTE’s website will display price charts, trading volumes and market evaluations for each 15-minute interval. Data exports to spreadsheet formats will also adapt to the 15-minute trading period. Matching curves will be published only with 15-minute trading resolution.

There will also be a change in electricity volume units, from MWh to MW. However, pricing will remain in EUR/MWh.Example of website publication:

Example of website data export

Exceptions may occur in Exceptional situations.

- What changes will occur in the API services?

-

- The structure of the JSON response remains unchanged

- The time range between deliveryStart and deliveryEnd will be 15 minutes instead of the current 60 minutes

- The period value represents the ordinal number of the trading interval within the day. It currently uses {1..24}, but will change to {1..96} (note: in transition days, {1..92} or {1..100})

Exceptions may occur in Exceptional situations.

Example:

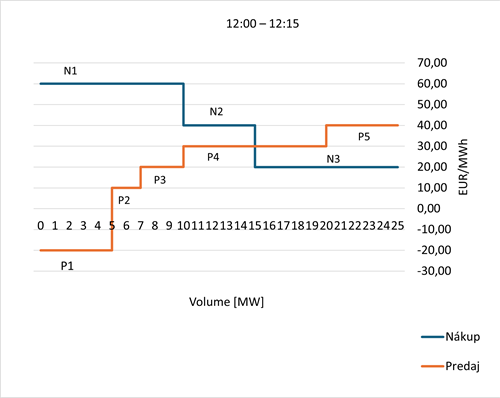

- How will the publication of matching curves change?

-

Matching curves will be generated exclusively for 15-minute trading periods as the smallest granularity (15’ and 60’).

Exceptions may occur in Exceptional situations.

Example of curve aggregation:

ID order

Period

MTU

Volume [MW]

Price [EUR/MWh]

Traded Volume [MW]

N1

12:00 - 13:00

60

10

60

10

N2

12:00 - 12:15

15

5

40

5

N3

12:00 - 12:15

15

10

20

0

P1

12:00 - 12:15

15

5

-20

0

P2

12:00 - 13:00

60

2,5

10

2,5

P3

12:00 - 12:15

15

2,5

20

2,5

P4

12:00 - 12:15

15

10

30

5

P5

12:00 - 12:15

15

5

40

0

Changes in Order Submission on the Day-Ahead MarketCollapse all

- How will order submission change?

-

Orders will now include an option to be submitted in 15-minute trading periods, while 60-minute intervals will still be supported. Available product selections will include:

- Hourly Products

- Standard order with a 60-minute period

- Quarter-Hourly Products (new)

- Standard order with a 15-minute period

- Hourly Block Products

- Simple block order (60-minute period)

- Linked block order (60-minute period)

- Flexible block order for one period (60-minute period)

- Exclusive group of simple block orders (60-minute period)

- Quarter-Hourly Block Products (new)

- Simple block order (15-minute period)

- Linked block order (15-minute period)

- Flexible block order for one period (15-minute period)

- Exclusive group of simple block orders (15-minute period)

Orders within a linked block or exclusive group must have the same trading period length.

- Hourly Products

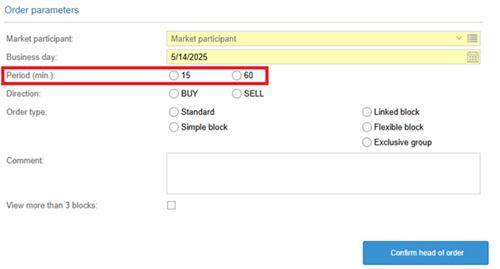

- How will the ISOT system’s order form change?

-

A new attribute will be added to the order header to specify the trading interval length.

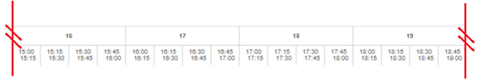

The time axis for quantity input will be extended to support the 15-minute trading interval.

- How do I submit 15-minute orders via Excel import?

-

A separate template will be available in ISOT for submitting 15-minute orders, using the same fill-in principles as existing templates.

- Will market participants need to modify their trading systems if using external interfaces?

-

Yes, even if participants continue submitting 60-minute orders. The order structure will require two new mandatory attributes: market and delivery-duration, without which the message will fail validation.

Participants are advised to review the new Data Exchange Technical Specification V1.20 to ensure smooth implementation of the 15’ MTU project.

Market Evaluation for ParticipantsCollapse all

- How will the new market evaluation process work?

-

The day-ahead market evaluation will be performed in 15-minute trading periods, even if the participant submitted a 60-minute order.

Exceptions may occur in Exceptional situations.

15 MTU Project LaunchCollapse all

- When is the 15-minute trading interval expected to launch?

-

The expected launch date is September 30, 2025, with the first auction trading day being October 01, 2025.

- How will the system transition to support 15-minute intervals?

-

On September 29, 2025, a planned outage is scheduled from 17:00 to 21:00. Following this outage (from 21:00 onwards), the ISOT system will support 15-minute order submissions through::

- Manual order entry form

- XLSX/XML import

- Automated data exchange per Technical Specification V1.20

- What if I submitted a 60-minute order for October 01, 2025 before September 30, 2025?

-

The order will remain valid and will be flagged for its interval duration. However, its evaluation will be conducted within the 15-minute trading periods.

Market Participant TestingCollapse all

- How is the 15 MTU project being tested?

-

Testing is available on the test environment at test-isot.okte.sk, where participants can test all order entry options and 15-minute period trading evaluation.

- How can I participate in testing?

-

An email must be sent to market@okte.sk with the subject “SDAC 15’ MTU Testing - Registration” containing the following details:

- A request for testing in the ISOT system + a valid certificate (if access to the testing environment is not set up)

- An email address for notifications during testing

If a market participant already has access to the testing environment from IDM tests in 2025, this access remains functional. However, it is still necessary to provide an email address for notifications during testing.

If a market participant does not have access to OKTE’s testing environment, they can request it by sending a Request for Testing in the XMtrade®/ISOT system, available on the OKTE website.

Registration is mandatory for participation in testing. There are no time or participant number restrictions for registration.

- Is testing available for external interfaces?

-

Yes, testing supports external interfaces, allowing for integration and verification of correct functionality in 15-minute trading periods before full deployment.

Information on Exceptional SituationsCollapse all

Order matching takes place in full coordinated matching across all bidding zones of the integrated day-ahead electricity market. In case of technical issues, local matching may be applied, using a standalone matching algorithm for the Slovak bidding zone (Annex No. 2 of the operational rules). Before activating this mode, market participants are informed, and order submission is opened to allow adjustments. All valid exclusive group block orders and 15-minute orders will be invalidated before and after the submission window for the standalone mode. The market evaluation algorithm in standalone mode only supports 60-minute orders.

In extreme cases, participants should be prepared to:

- Submit only 60-minute orders for the trading day

- Process day-ahead market evaluation in 60-minute intervals

- Handle results exclusively in 60-minute intervals for that trading day

- Time range in the API between deliveryStart and deliveryEnd may be 60 minutes

- Exported results will be available in 60-minute intervals

- Analyse matching curves in 60-minute intervals